When buying for car insurance policy, you'll notice that prices vary by area and that state legislations dictate which protection is required on your plan and also what the minimum limitations are. There are a lot of great insurance provider that run regionally or only in a select quantity of states.

Auto-Owners provides coverage in only 26 states, while Erie provides it in simply 12 (money). What type of insurance coverage does your state legitimately require you to have? In a lot of states, bodily injury obligation coverage and building damages responsibility are necessary to drive, but you'll intend to examine the specifics of insurance policy costs with vehicle insurance coverage service providers where you live.

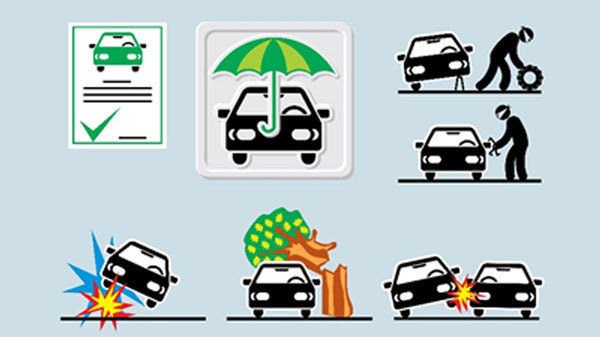

Necessary; 2. Frequently required; 3. Optional. Keep in mind that this list does not consist of all kinds of insurance coverage offered by carriers-- these are simply the most typical. Required insurance coverage: Simply regarding all states call for both kinds of insurance coverage listed below, which do not cover damages to your own car or property.: This protection pays for injuries to others triggered by the policyholder and other drivers detailed on the policy.

perks risks cheapest risks

perks risks cheapest risks

If your vehicle is funded, your lender may require you to carry full coverage, suggesting both thorough as well as collision. This coverage spends for damages to your vehicle in an accident arising from an accident between your car and an additional automobile or an object.: This protection pays for damage to your cars and truck created by an occasion apart from collision - perks.

Nonetheless, we might obtain compensation when you click on links to services or products used by our partners (vehicle insurance).

PREPARED TO DISCOVER THE IDEAL CAR INSURANCE COVERAGE FOR YOU? The Best Vehicle Insurance Policy Firms for 2022Money, Nerd has actually placed the ideal automobile insurance policy firms based on numerous aspects, consisting of J.D. Power consumer fulfillment scores, economic security ratings from AM Finest and cost.

Not known Details About Progressive: An Insurance Company You Can Rely On

GEICO received the highest marks in our racking up system for 24 out of 50 states, while State Farm rated as the leading company in 10 states. These positions, and also our study on what makes these firms stick out, can help you when shopping for vehicle insurance policy. Those simply seeking one of the most budget friendly alternative can contrast this checklist to our positions of the least expensive vehicle insurance provider - vans.

GEICO might not be the best choice for those with a brand brand-new car. The firm doesn't offer new automobile replacement coverage, which permits those with new models to be totally repaid for a new vehicle after an accident. Without this, you'll only be compensated for the depreciated worth of your car.

You can save a lot more on your regular monthly expense by packing with State Farm's residence insurance. State Ranch does not supply much in the way of unique protections: you'll mainly locate basic auto insurance protections and typical add-ons such as roadside aid and also rental auto expense coverage. It offers few unique perks, you're extra most likely to obtain excellent worth with State Farm than the majority of various other major insurance firms.

Like GEICO, State Ranch does not offer brand-new car substitute insurance coverage, so it might not be the best option for those with brand-new cars and trucks who are fretted about obtaining value back if they enter into a mishap soon after their automobile purchase. Compare Vehicle Insurance Fees, Ensure you're obtaining the most effective price for your cars and truck insurance coverage.

The Top Vehicle Insurer in Your State, Due to the fact that insurance is controlled at a state degree, Money, Nerd placed the most effective car insurance in each state based upon neighborhood pricing and also local J.D. Power scores - auto. Excluding, which is not available to the majority of motorists, many often placed as the very best insurance firm in a state (24 times).

Click on your state to discover more regarding the best car insurance coverage firm where you live.

Not known Details About Metlife: Insurance And Employee Benefits

We have actually given our suggestions for the ideal auto insurer for young drivers, chauffeurs with poor credit report and also vehicle drivers with a mishap on their documents, every one of whom are normally charged higher prices than the average chauffeur. THE VERY BEST VEHICLE INSURER BY Find more info Vehicle Driver PROFILEBest Vehicle Insurer for Customer Care: Auto-Owners, If price is not as important for you as ensuring you're going to obtain the very best feasible service when you need to sue, Cash, Nerd discovered that has the ideal combination of high contentment and low problems.

It likewise has a low client complaint rate, as measured by the National Organization of Insurance Policy Commissioners. Additionally, Auto-Owners uses new car substitute protection as an add-on. insured car. If you get this, you will not need to fret that your new auto sheds value as soon as you drive it off the great deal.

business insurance insurance companies insurers cheap insurance

business insurance insurance companies insurers cheap insurance

Some insurance provider are better fit for motorists with offenses in their history (insurance affordable). If you're a chauffeur with tickets or accidents on your record, Cash, Nerd found that is normally the most effective alternative. Top Pick: State Farm (Average Cash, Geek Score: 4. 2/ 5)pros, This is an icon, Inexpensive for those with offenses on their documents, This is an icon, Supplies both roadside aid as well as rental auto reimbursementcons, This is an icon, Does not offer accident forgiveness, In 22 states extra than any kind of various other firm State Farm is the most effective equilibrium of affordability and also solution for risky motorists.

And it doesn't compromise its service online reputation to attain those low rates. Like a lot of insurance companies, State Farm offers roadside help and rental cars and truck expenditures coverage. In case you do enter problem when driving, these insurance coverages can aid you come back residence and also supplying alternative transportation while your car is in the store.

EVEN MORE ABOUT Risky INSURANCEBest Car Insurance Business for Young Drivers: Allstate, If you're adding a young motorist to your plan, there are a number of premium policy alternatives offered - cheapest. Both GEICO as well as Allstate place high in Money, Geek's racking up system for over 15 states for a plan with a young vehicle driver, but we chose as our victor offered that it uses a far-off pupil discount rate as well as GEICO does not.

Allstate is an excellent choice if you're letting your teen drive your brand-new cars and truck. If you add new vehicle replacement protection, you can replace your car with a completely new model after a mishap, as long as the version is two years of ages or less. And also, if you add crash mercy, you won't have to fret about your insurance policy rates raising after your teenager's initial crash - cheaper cars.

The 20-Second Trick For How Much Car Insurance Do I Need? - Ramseysolutions.com

Of the insurance providers satisfying this standard, ranks top. Leading Select: Allstate (Ordinary Cash, Geek Rating: 3. 6/ 5)pros, This is a symbol, Provides new vehicle substitute insurance coverage, This is a symbol, Has a low rate of client complaintscons, This is an icon, Does not place amongst the cheapest insurers, Allstate provides a balance of cost and good client service while providing its motorists the choice to buy new car replacement protection.

insured car cheaper auto insurance auto insurance car

insured car cheaper auto insurance auto insurance car

You can conserve with most of one of the most common price cuts for being a safe driver, packing house and vehicle and also anti-theft as well as having air bags as well as various other security attributes. Best Vehicle Insurer for Unique Protections: Liberty Mutual, At the end of the day, many automobile insurance provider use coverages needed by state legislation and also bit a lot more. auto.

Finest Vehicle Insurance Provider for Low Mileage Drivers: Metromile, Low gas mileage discounts are relatively unusual and also tend to be rather small. If you barely drive, the most effective means to conserve may be with a pay-per-mile insurance provider such as Metromile. Cash, Nerd found that pay-per-mile insurance policy can be worth it if you only often tend to drive a couple of miles per day.

Presently, it's the only insurance provider completely specialized in pay-per-mile insurance coverage (dui). Nevertheless, the company does have a high rate of consumer complaints. As typical insurer enter the marketplace for pay-per-mile insurance, it might make feeling to attempt several of their programs, such as Nationwide's Smart, Miles and also Allstate's Milewise, which are expanding their availability.

Incorporate that with excellent prices, and also USAA is likely to offer you the finest worth for your money. USAA does not offer numerous unique alternatives coverages, however it does have one of the most widely relevant ones, such as roadside aid, rental cars and truck reimbursement and also accident forgiveness. It is likewise an excellent choice if you benefit Uber or Lyft as it supplies rideshare insurance coverage.

Compare Automobile Insurance Rates, Ensure you are getting the ideal price for your car insurance coverage. Compare quotes from the leading insurer. Actions to Find the very best Auto Insurer, Locating the most effective automobile insurance for you will depend on your concerns. If you wish to save cash, you could decide for the insurance provider that provides you the most affordable quote.

The Basic Principles Of 10 Best Car Insurance Companies Of 2022 - Wallethub

affordable auto insurance auto insurance company insurance affordable

affordable auto insurance auto insurance company insurance affordable

Cash, Geek extremely suggests beginning with our referrals for the top business in your state - credit. 2Compare Actual Quotes from Insurance Providers, As soon as you have actually narrowed down a list of companies that have quality solution, you must go obtain a quote from that company. Our rankings for the least expensive companies are a terrific overview as to which firms are most inexpensive typically, yet the cheapest for you may be different as a result of your distinct motorist features.

Firms with an A+ or A++ from A.M. Finest are the most secure. The Ideal Firm for You Has a Strong Consumer Solution Reputation, You can take several steps to figure out which insurance business has the finest customer solution for you (car insurance).

If you want to do your very own study, J.D. Power launches an overall auto insurance contentment research as well as a cases satisfaction research study yearly. And if you desire to dig deep into the data, your state department of insurance coverage website has public information on how much consumers complain about insurance policy firms in your state - insurance.

Compare Quotes From the Ideal Companies to Obtain Worth For Your Cash, As soon as you've limited the firms with solid customer service credibilities, you ought to compare quotes amongst them (cheaper auto insurance). Insurance coverage firms use a range of factors to compute your price. As an outcome, you could discover that 2 companies have extremely comparable customer support reputations however estimate you at greatly different rates.

Others may simply not be able to manage it. In these instances, there may be state programs offered to help. State-Sponsored Auto Insurance Coverage Programs for High-Risk Drivers, While some companies offer individual auto insurance plan to high-risk vehicle drivers, numerous choose not to. Instead, states require all insurance provider to join a program that swimming pools these sort of motorists.

The finest automobile insurance policy business for you may depend on your chauffeur profile as well as where you live. Who has the best automobile insurance coverage in your state? Not every insurance policy business writes policies in all 50 states. liability.

What Does The Best Car Insurance Companies For 2022 - Moneygeek Do?

When you seek the best car insurance coverage in your state by state, get your very own quotes and also look right into the client service track records of local insurance companies utilizing our Money, Geek ratings or with your state division of insurance. Can you discover excellent, affordable automobile insurance policy? Yes. Several insurer with strong scores for cases service as well as overall consumer complete satisfaction likewise offer some of one of the most economical prices generally.

Tighten down your list of companies to those that have a strong customer support reputation - cheapest car. From there, if you want to obtain the very best worth for your cash, you should contrast prices amongst these insurance provider to see whether some quote you at a a lot more budget-friendly rate than others.